Publishing Twice a Week

The Macdonald Notebook is your source for exclusive Business & Inside Politics publishing every Saturday and Sunday.

Latest Issue

Baltimore Bridge: Could It Happen In Port of Halifax? Part VI

Exclusive: Last Weekend Port of Halifax Faced Closure To Large Ships – Here’s Why…

Alison Strachan: Fond Memories of Lunenburg’s Joy Saunders

Dalhousie’s Role as ‘Civic University’ More Relevant than Ever: President Kim Brooks

Authors Gather In Halifax For Book Reading Events

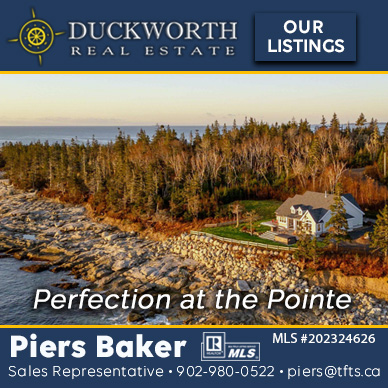

In This Harbour Town, Affordable Iconic Fishing Captains’ Mansions For Under $400,000

MacPolitics: MacLeod Wins Pictou West Nod

Liberals Could Face Contested Nomination In Pictou West

Saturday Edition, Below

Alison Strachan: Something’s Got To Change And I’m Not Alone In Thinking This Way

Sandra Bryant Downsizing Office Needs, Expects Busy Season

Containerized Cargo Volume Down Dramatically In Port Of Halifax

Halifax Port: Board Member Carol Ann Miller Goes On Overseas Trip. Will She Suffer Diana Dalton’s Fate?

St. Martha’s Regional Hospital: A Snoop Looked At Health Records Of Thousands Of Antigonish Patients And Was Fired

MacPolitics: Jamie Baillie: We Need A Halifax Mayoral Contender Who Can Coalesce Tory-Liberal Support

MacPolitics: Brad Johns Out Of Houston Cabinet After Epidemic Remark

MacPolitics: Michelle Livingston Has Left The Building

That Is The End Of The Saturday Edition

Check Out The Notebook Archives For 7,200 stories Since Founding Year of 2017

From The Notebook Archives: The Significance Of Port Of Halifax’s Cruise Ship Industry

Feb 8, 2019 | Transportation

Return Home

Contact The Editor

Articles by Topic

- Art Hustins Jr: Life & Times (4)

- Baltimore Bridge: Could It Happen In Port of Halifax? (7)

- Barry Rofihe's Life & Times (5)

- Cabot Links (142)

- Chester Notes (69)

- Dan Leger's Book On Stephen McNeil (11)

- Electric vehicles Feature (12)

- Halifax Downtown Grocer Wars: Arthur's Takes On Pete's (4)

- Immigration: One Million NS Residents - Features (20)

- Jim Vibert Columns (18)

- John Carroll's Incredible Life & Times (7)

- John Risley: The Book - Net Worth (6)

- Lunch With Alison (83)

- Lunenburg Common Lands (62)

- Maritime Business (125)

- Melford Container Terminal (5)

- Millennial Entrepreneurs (42)

- NATO's Halifax Tech HQ (6)

- NS Liberal Cover-Up Coverage (70)

- NSLC (1)

- NSLC/Craft Beer/NS Wines (166)

- Pasta Primavera's Yarmouth Creation (12)

- Porsche Of Halifax Features (8)

- Premier's Office: Abrupt Departure Of Trusted Politcal Aide (7)

- Restaurants (91)

- Seafood Recipes By Home Chef Gary Phillipe (10)

- Taxing Out Of Province Homebuyers - News Features (33)

- The Donair Features (14)

- The Incredible & Significant Life & Times Of John MacDonell (4)

- The Incredible Life & Times of Butch Heisler (6)

- The Life & Times Of John Young & Carol Young (14)

- The Life & Times Of Terry Burns - Pro Golfer & Expert Sailor (5)

- The Notebook Seal Of Approval (4)

- Tom Peters' Golf Tour (28)

- Trudeau Gov Won't Fund Large Road Twinning (4)

- Truro Inland Cargo Terminal Project (20)

- Women In Non-Traditional Occupations (6)