Publishing Twice a Week

The Macdonald Notebook is your source for exclusive Business & Inside Politics publishing every Saturday and Sunday.

Latest Issue

Baltimore Bridge: Could It Happen In Port of Halifax? Part VI

Exclusive: Last Weekend Port of Halifax Faced Closure To Large Ships – Here’s Why…

Alison Strachan: Fond Memories of Lunenburg’s Joy Saunders

Dalhousie’s Role as ‘Civic University’ More Relevant than Ever: President Kim Brooks

Authors Gather In Halifax For Book Reading Events

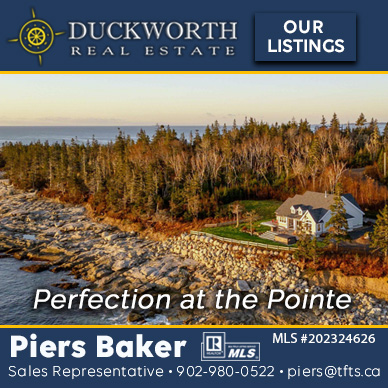

In This Harbour Town, Affordable Iconic Fishing Captains’ Mansions For Under $400,000

MacPolitics: MacLeod Wins Pictou West Nod

Liberals Could Face Contested Nomination In Pictou West

Saturday Edition, Below

Alison Strachan: Something’s Got To Change And I’m Not Alone In Thinking This Way

Sandra Bryant Downsizing Office Needs, Expects Busy Season

Containerized Cargo Volume Down Dramatically In Port Of Halifax

Halifax Port: Board Member Carol Ann Miller Goes On Overseas Trip. Will She Suffer Diana Dalton’s Fate?

St. Martha’s Regional Hospital: A Snoop Looked At Health Records Of Thousands Of Antigonish Patients And Was Fired

MacPolitics: Jamie Baillie: We Need A Halifax Mayoral Contender Who Can Coalesce Tory-Liberal Support

MacPolitics: Brad Johns Out Of Houston Cabinet After Epidemic Remark

MacPolitics: Michelle Livingston Has Left The Building

That Is The End Of The Saturday Edition

Check Out The Notebook Archives For 7,200 stories Since Founding Year of 2017

Notebook Archives: The Significant Economic Impact Of NS Craft Breweries – All 50 Of Them

Feb 8, 2019 | Business

Return Home

Contact The Editor

Articles by Topic

- Art Hustins Jr: Life & Times (4)

- Baltimore Bridge: Could It Happen In Port of Halifax? (7)

- Barry Rofihe's Life & Times (5)

- Cabot Links (142)

- Chester Notes (69)

- Dan Leger's Book On Stephen McNeil (11)

- Electric vehicles Feature (12)

- Halifax Downtown Grocer Wars: Arthur's Takes On Pete's (4)

- Immigration: One Million NS Residents - Features (20)

- Jim Vibert Columns (18)

- John Carroll's Incredible Life & Times (7)

- John Risley: The Book - Net Worth (6)

- Lunch With Alison (83)

- Lunenburg Common Lands (62)

- Maritime Business (125)

- Melford Container Terminal (5)

- Millennial Entrepreneurs (42)

- NATO's Halifax Tech HQ (6)

- NS Liberal Cover-Up Coverage (70)

- NSLC (1)

- NSLC/Craft Beer/NS Wines (166)

- Pasta Primavera's Yarmouth Creation (12)

- Porsche Of Halifax Features (8)

- Premier's Office: Abrupt Departure Of Trusted Politcal Aide (7)

- Restaurants (91)

- Seafood Recipes By Home Chef Gary Phillipe (10)

- Taxing Out Of Province Homebuyers - News Features (33)

- The Donair Features (14)

- The Incredible & Significant Life & Times Of John MacDonell (4)

- The Incredible Life & Times of Butch Heisler (6)

- The Life & Times Of John Young & Carol Young (14)

- The Life & Times Of Terry Burns - Pro Golfer & Expert Sailor (5)

- The Notebook Seal Of Approval (4)

- Tom Peters' Golf Tour (28)

- Trudeau Gov Won't Fund Large Road Twinning (4)

- Truro Inland Cargo Terminal Project (20)

- Women In Non-Traditional Occupations (6)